Easy Loan App For Secure And Smooth Approval

Managing short-term financial needs has become easier with digital lending solutions. An easy loan app allows users to apply for loans directly from their mobile device without lengthy procedures. Whether the requirement is a small cash loan for emergencies or planned expenses, these platforms are designed to simplify borrowing while maintaining security and transparency.

With rising everyday costs, people often look for quick access to loans that do not involve complicated documentation or delays. A well-designed easy loan app focuses on user convenience, clear terms, and responsible borrowing. It offers a practical way to request a cash loan while staying informed about repayment obligations. This explains how such apps work, their benefits, and how to choose the right one for your needs.

Understanding the Concept of an Easy Loan App

An easy loan app is a digital platform that allows users to apply for loans online through a mobile application or web interface. These apps are built to reduce the effort traditionally associated with borrowing money. Instead of visiting multiple offices, users can submit details, upload basic documents, and track loan status from one place.

The goal of an easy loan app is to make loans accessible while ensuring a smooth approval process. Most platforms use digital verification methods to assess eligibility. This helps reduce processing time and provides faster decisions compared to manual systems.

How an Easy Loan App Works

Simple Application Process

The process usually begins with downloading the app or accessing the online form. Users provide personal and financial details, such as income information and identification. The interface is designed to be clear, allowing applicants to complete the steps without confusion.

Digital Verification

After submitting the application, digital checks are carried out to verify the information. This step helps ensure security and reduces errors. Because verification is automated, the approval process remains smooth and timely.

Loan Approval and Disbursal

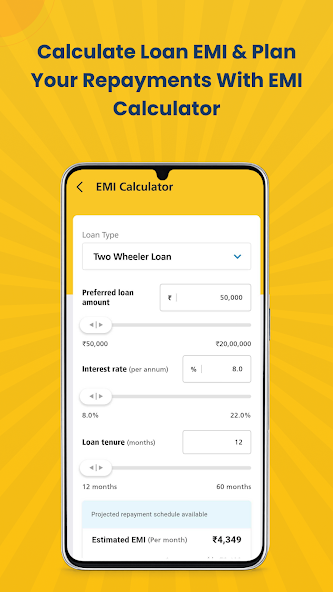

Once approved, the loan amount is transferred to the user’s account. Whether it is a small cash loan or a higher-value request, the disbursal process is designed to be efficient. Users can also view repayment schedules within the app.

Benefits of Using an Easy Loan App

Convenience and Accessibility

One of the main advantages is the ability to apply anytime and from anywhere. Users do not need to adjust their schedules or wait in lines. This convenience makes loans more accessible to a wider audience.

Clear Information

An easy loan app provides detailed information about interest rates, repayment periods, and total payable amounts. This clarity helps users make informed decisions before accepting loans.

Faster Decisions

Because the process relies on digital systems, approvals are often quicker. This is especially useful during urgent situations when a cash loan is needed without delay.

Types of Loans Available Through Easy Loan Apps

Short-Term Loans

These loans are suitable for immediate needs and usually have shorter repayment periods. They are commonly used for emergencies or temporary cash flow gaps.

Personal Loans

Personal loans can be used for various purposes, such as household expenses or education-related costs. An easy loan app allows users to select loan amounts and tenures that match their repayment capacity.

Emergency Cash Loans

Emergency cash loan options focus on quick access and simplified approval. These loans are designed to provide support during unexpected situations.

Security and Data Protection Measures

Security is a key concern when applying for loans online. A reliable easy loan app follows strict data protection practices. User information is handled through secure systems to prevent unauthorized access.

Digital platforms also use verification checks to reduce fraud risks. By ensuring that data is processed responsibly, these apps create a safer environment for managing loans.

Factors to Consider Before Applying

Eligibility Criteria

Each platform has specific eligibility requirements related to age, income, and employment status. Understanding these criteria helps avoid unnecessary rejections.

Repayment Terms

Before accepting loans, users should review repayment schedules carefully. Timely repayment helps maintain financial discipline and avoids additional charges.

Transparency

A trustworthy easy loan app provides full details upfront. Users should ensure there are no unclear conditions before proceeding with a cash loan.

Responsible Borrowing Through Easy Loan Apps

While easy access to loans is helpful, responsible borrowing remains important. Users should borrow only what they can repay comfortably. Planning repayments in advance helps avoid financial stress.

An easy loan app supports responsible borrowing by displaying repayment details clearly. This encourages users to manage loans efficiently and stay on track with their financial goals.

How Easy Loan Apps Support Financial Planning

Easy loan apps are not just about borrowing. They also help users plan finances by offering structured repayment options. Users can choose tenures that align with their income patterns.

By providing access to loans with clear terms, these platforms help individuals manage expenses without disrupting long-term plans. A properly used cash loan can act as a temporary support tool rather than a burden.

Common Mistakes to Avoid

- Applying for loans without checking repayment capacity

- Ignoring repayment dates

- Borrowing more than required

- Overlooking complete loan terms

Avoiding these mistakes helps ensure a smooth experience with an easy loan app.

Conclusion

An easy loan app offers a practical solution for those seeking simple and secure access to loans. With a user-friendly process, digital verification, and transparent information, these platforms make borrowing more manageable. Whether applying for a small cash loan or planning short-term financial support, users can benefit from a smooth approval experience when they choose wisely.

By understanding how these apps work and borrowing responsibly, individuals can use loans effectively without unnecessary stress. A reliable easy loan app helps bridge financial gaps while maintaining clarity and control. When used carefully, cash loan options and other loans become supportive tools that fit into everyday financial planning.