Building Wealth 101: A Beginner’s Guide To Personal Finance

Who doesn’t want to succeed in finances? I haven’t heard of anyone who doesn’t strive for financial success, and rightly so, as it is one of the most important parts of our lives. Having a stable life has a lot to do with having a stable financial life, but often, people feel elusive about it, especially those who are just starting with their finance management. Building wealth isn’t some gimmick or rocket science that we cannot understand; it is a style where, with basic principles and formulas, we can create wealth over time. We will talk more about it in the article and understand how we should start with personal finance.

1.Set Clear Financial Goals

The very first step is to have a clear picture of your financial goals or aspiration. What do you truly want to achieve? Are you saving for buying your dream home at the most prime location or retirement plans, or do you just want to pay off your debts completely and that’s why planning to an instant personal loan? These questions can only be answered by you, as you are the one who knows your situation the best. This real reflection of your financial goals gives a mindset with which we can create a roadmap and achieve each one of our goals effortlessly.

2.Create a Budget

If I have to define a budget in two words, then it would simply be a financial roadmap. Because it is truly a financial roadmap where we track our income and expenses. For creating a budget, start by listing your income in a diary, followed by the expenses, it would ideally include your housing, groceries, clothes, and other necessities. Now, after analyzing the income and expenses, take out a sum of money and keep it aside for savings or debt repayment. Now ensure that you are sticking to this payment and not taking money out of it at month’s end.

3.Build an Emergency Fund

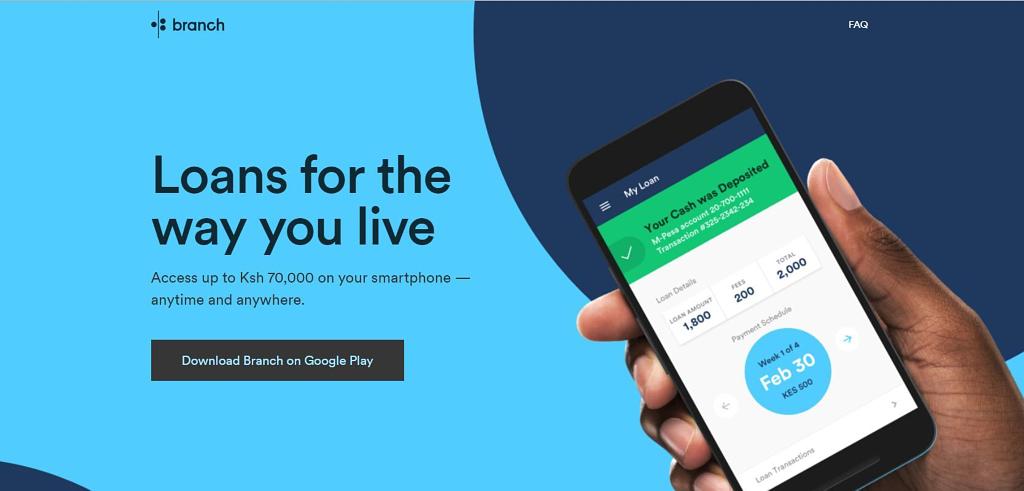

Life is truly unpredictable especially after facing such a huge pandemic and losing our loved ones; we have learned this. So, create an emergency fund where you will contribute some money every month. This fund could be your three to six months of expenses as this will be working as a safety net during times of financial hardships. You also get emergency mobile loans for this purpose.

4.Seek Professional Advice

If you feel your financial situation is different from others or very complex, always consider getting help from professionals in this field. Google about certified financial planners or certified public accountants and get valuable insights through them and make better choices in your planning, they will tell you if you need to get some fast loans to manage all of your previous debts or expenses or simply need to save more to cover up everything.

5.Monitor Your Progress

Monitoring your progress is crucial as it reflects how much you’ve been able to succeed in your plans. So make adjustments every quarter or six months, whatever suits you the best, and remember to celebrate all of your milestones, no matter how small or big they are. It keeps you motivated and ensures you continue working towards the goal in the long run.

Conclusion

So the jist about building wealth starts with including good financial habits within ourselves and taking necessary steps towards it. Setting a clear goal and then creating a roadmap is the only way to create wealth over time. Paying debts should be your priority if you have any, if it is a huge sum of money, think about getting an instant loan from an urgent loan app that provides quick access to funds and then focus on investment as, in this case, money works for you and not you working for money. And lastly, remember, the journey to wealth begins with the first step, so start today!